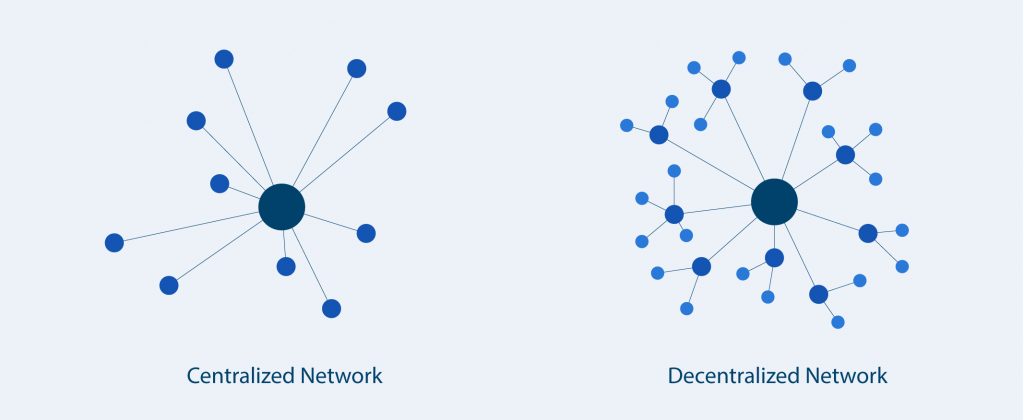

Currently, there are at least two hundred cryptocurrency exchanges to trade coins. However, depending on the type of operation, cryptocurrency exchanges can be classified either as centralized or decentralized. Centralized exchanges have been, until now, the primary platform for trading cryptocurrencies.

Simply referred to as CCEs, centralized cryptocurrency exchanges operate in a similar manner to stock markets, implying that they are owned and controlled by a single organization that boasts complete control of all transactions. Simply put, CCEs make use of intermediaries or middlemen, much as you would use and trust a financial institution to manage your financial assets.

These intermediaries act as stockbrokers, conducting transactions and trading on behalf of users. Centralized cryptocurrency exchanges are where order reviewing, routing, matching between traders as well as the execution of order transactions via exchange software and servers, occur.

CCE subscribers don’t have access to the private keys of their exchange wallet’s account, which are the software platforms used to execute important management functions, but rather access the account through a process referred to as custody. For instance, when you purchase bitcoin, the value will only appear in your account. But, you don’t own it and therefore, cannot manage the amount since it is in custody.

And for you to have control over it, you must ask for a transfer of your funds to your external wallet address from your cryptocurrency exchange provider. Transactions can only occur after the verification by the relevant players within the exchange authorized by a central body.

But, What Is A DEX In Crypto?

Decentralized cryptocurrency exchanges are the complete opposite of their centralized counterparts. They are autonomous decentralized cryptocurrency applications that permit crypto coin buyers and sellers to trade without having to surrender their funds to any custodian or intermediary.

As you may have guessed, this type of trading is entirely different from centralized exchanges where you have to hand over your cryptocurrency assets to the exchange, which acts as an intermediary. Simply put, decentralized exchanges eliminate the need for any authority to approve transactions within a particular exchange.

Decentralized cryptocurrency exchanges are also not owned and managed by a single firm. They don’t keep custody of clients’ funds, information, or positions, only serving as a routing layer for transaction orders. There is no need for an intermediary body to control user funds or manage the ledger. Instead, decentralized cryptocurrency exchanges allow crypto users to take place directly between players in a peer-to-peer manner through the assistance of an automated process.

So, how do decentralized exchanges function?

There are three main types of decentralized exchanges, including:

– On-Chain Order Books: In this type of decentralized exchange, everything is conducted on-chain, implying that every order is written to the blockchain. There are network nodes assigned to maintain order records.

Miners are required to confirm every transaction. Common platforms that embrace the use of on-chain order books include StellarTerm and Bitshares. This is arguably the most transparent approach perhaps because you don’t depend on a third party to relay the orders to you.

– Off-chain order books: Unlike their on-chain order book counterparts, transaction records in off-chain order books are hosted in a centralized firm. This means that instead of orders being hosted to the blockchain, they are hosted elsewhere. They involve the use of relayers to help manage order books.

Off-chain order books are somewhat more superior in terms of usability, simply because they don’t experience speed constraints, as they don’t use the blockchain as much. Common examples of decentralized crypto exchanges that use off-chain order books include EtherDelta and 0x.

– Automated Market Makers: These became popular in 2020 and have continued to gain lots of traction ever since. They do not need to order books and instead, use smart contracts to create liquidity pools that automatically execute transactions depending on some parameters. Today’s AMM-based decentralized exchanges are relatively user-friendly, integrating with popular wallets such as TrustWallet and MetaMask.

Benefits of Decentralized Crypto Exchanges

Reduced security risk:

Arguably, hacking is the greatest risk facing centralized cryptocurrency exchanges. Security beaches associated with platforms such as Bitfinex and Coincheck have damaged the reputation of the crypto industry. The custodial nature of centralized exchanges is usually seen as the major reason why they are prime targets for thieves and hackers. They maintain liquidity by keeping custody of the clients on their platforms, and this makes them extremely susceptible to large-scale theft.

Decentralized crypto exchanges are not exposed to this type of risk because users are able to freely trade without having to surrender their vital information to third parties and have complete control over how and what they transact. The users are the ones in charge of maintaining their accounts’ security. What’s more, it would not be quite profitable for hackers to steal money from individual users. This makes decentralized exchanges relatively safer.

Privacy:

In all of the centralized exchange platforms, users are required to sign up by providing key information for compliance. And when you give up your personal information to a third party, you are not always going to safe!

Thankfully, with decentralized cryptocurrency exchanges, you are not obliged to provide their personal information to third parties and you also won’t be needed to register to use the exchange. However, it is worth noting that there are plans by the U.S regulators and the FATF (Financial Action Task Force) to enforce the Know Your Customer requirements on crypto wallets by the end of this year!

Cheaper transaction charges:

This is another major benefit associated with DEXs. Generally, trading on decentralized exchanges has fairly lower fees. This poses a huge risk to centralized exchange operators because every crypto trader out there is always looking for the cheapest transaction rates.

Sovereignty:

Simply referred to as control over one’s coins, sovereignty is encouraged in decentralized cryptocurrency exchanges. This means that traders have full custody of their money and are free to use those funds as they would want. There are no concerns such as exchange operators blocking or freezing the assets of users.

The Bottom line:

Crypto traders are always looking for the best strategy and ways to maximize their returns. Even though decentralized crypto exchanges might not be the best solution to some of the problems experienced by centralized exchange platforms, they guarantee a number of benefits including enhanced convenience, security, and privacy.