Arbitrage trading is a good way of making instant profits. As a trader who most probably invests in cryptocurrencies, you are aware of these opportunities. They are rare and almost undetectable. There are, however, various arbitrage trading software for cryptocurrencies that will help you detect these rare opportunities and ensure you take full advantage of them to make maximum profit.

What is arbitrage trading?

If you are new in the cryptocurrency industry, you may not be aware of arbitrage trading. Arbitrage trading is the simultaneous sale and purchase of assets to benefit from an imbalance in prices.

Arbitrage trading ensures you take advantage of market inefficiencies resulting in the mispricing of similar assets in the markets, or similar assets from different brokers or different markets. There are three main software programs you could use to help detect this imbalance in pricing; remote alert programs, alert programs, and automatic trading software programs.

Automatic trading software

Automatic trading software

Arbitrage trading as we have seen usually exist for a short period, usually a few seconds, therefore it might be time-consuming for cryptocurrency traders to do calculations manually. And in most cases, these opportunities would have elapsed before you come up with a price difference. It is therefore essential that you use a variety of software that will help you detect and calculate the price imbalance instantly.

One such software is the automatic trading software. This type of program usually is loaded onto your brokerage trading platform. When the software detects an imbalance in pricing, it calculates the difference and initiates the trade on your behalf. Automatic trading software generally is designed to overcome one of the main problems in arbitrage trading: accurate and timely trade execution that is critical in taking advantage of trading opportunities that only exist for a brief period.

Arbitrage Scanner

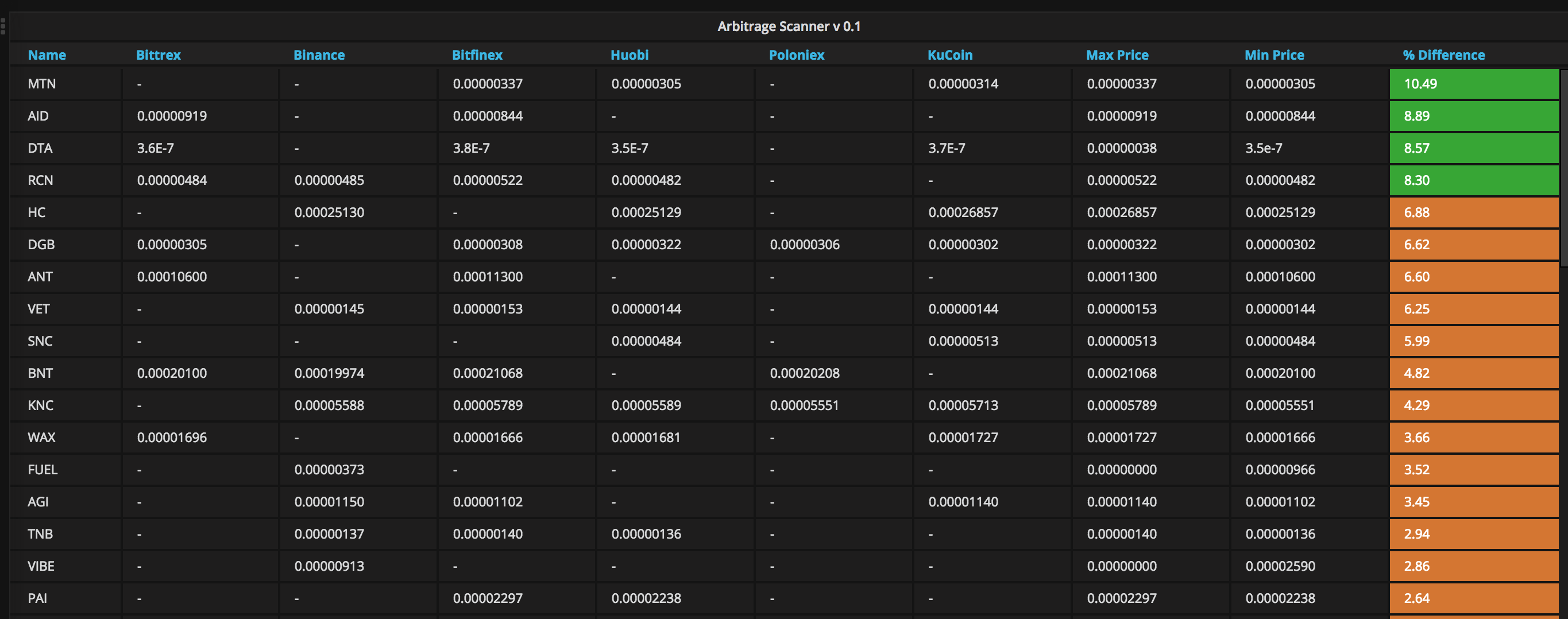

An Arbitrage Scanner checks across various exchanges to find the lowest and highest price, Cryptolume has one readily available inside it’s massive toolset suite. You can see an example of it below:

Trade alert programs

If you are not comfortable with having trades executed automatically, you could prefer making all final trading decisions yourself using a trade alert software. The trading alert software works the same as automatic trading software and usually scans various markets brokers and instruments for arbitrage trading opportunities. When the software detects an arbitrage trading opportunities, it alerts you of the opportunity rather than executing it automatically. You then decide on whether to perform the trading opportunity or not.

This is one of the reasons Cryptolume was created, you can find more about us here.

Remote alert programs

Remote alert software is another Arbitrage trading software for cryptocurrencies. This software usually requires traders to subscribe to a remote alert service that enables you to get alerts on arbitrage trading opportunities similar to the alerts you get using your software. The only difference is that you will be receiving signal alerts by software that runs at a different location outside of your private network or computer. Some traders may prefer using this software rather than running software on their private network or computer. Programs running on your computer may sometimes be bulky and may slow down your computer making you miss these arbitrage opportunities.

Conclusion

Arbitrage trading software for cryptocurrencies is a good way of capitalizing on the few mistakes that occasionally occur in pricing on the cryptocurrency industry. Take advantage of this three software and ensure you always benefit from arbitrary trading opportunities.